Advantages

Avoid financial shortfalls if you are unable to work for health reasons (from 25%).

Close the gap to gross pay.

Maintain your standard of living.

For employees, self-employed workers and inactive people.

Our benefits

You can insure against accident, illness or a combination of the two.

A loss of earnings after giving birth is included in the daily sickness allowance. At least eight weeks of daily allowance benefits are covered.

You can insure your entire salary or only parts of it.

Self-employed people can also insure certain fixed costs in addition to their income.

Housewives and househusbands, people in education and family members working in a family business who do not receive a salary in cash may take out insurance up to the amount of the simple AHV maximum pension.

Save on premiums with the no-claims discount

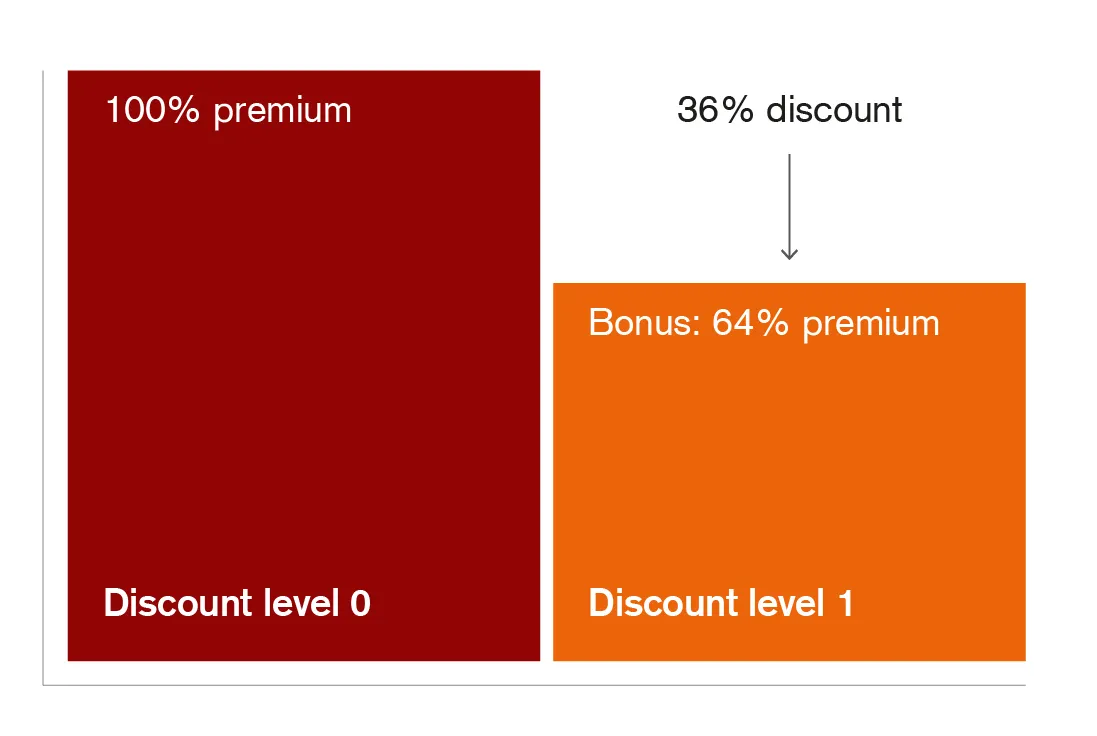

ÖKK provides you with a discount of 36 percent on ÖKK COMPENSA if you do not draw any benefits from the policy (discount level 1). The discount ceases to apply once you claim any benefits; you are then returned to discount level 0. If you then do not claim any benefits from the ÖKK COMPENSA policy over the following three year period, you are returned to discount level 1.

The observation period runs from 1 September (or the start of the insurance policy) to 31 August of the following year.

Requirements

- between 15 and 60 years old

- fully able to work on application

- Resident of Switzerland

Questions and answers (FAQ)

ÖKK COMPENSA is aimed at employees, self-employed workers and inactive people (housewives and househusbands, people in education and family members working in a family business who do not receive a salary in cash) who wish to avoid financial shortfalls if they are unable to work for health reasons.

A certificate of an inability to work must be issued by a medical specialist or chiropractor recognised by ÖKK.

The amount of the daily allowance is agreed between the insured person and the insurer. The daily allowance corresponds to one 365th of the insured loss of income in any one year. The maximum cover is CHF 200,000 per year (for people transferring from an ÖKK collective insurance policy, up to CHF 250,000).

The premium amount is based on the level of risk and depends, for example, on a person’s age, place of residence, agreed waiting period, daily allowance amount, insured risks as well as the duration of the insured benefits.

A person is entitled to benefits after the end of the waiting period, for example on the day they give birth. The waiting period begins on the first day on which they are unable to work (three days before their first medical treatment at the earliest). Waiting periods of up to and including 21 days are recalculated for each case of illness or accident. Longer waiting periods apply once each calendar year only.

The duration of benefits is listed in the insurance policy and measured according to the particular insurance claim. For illness and accident combined, the insured daily allowance is paid out for a maximum of 730 or 365 days.